Two former Georgia election workers who are suing conservative media outlet Gateway Pundit have alleged that the company’s bankruptcy filing is explicitly designed to delay or avoid consequences in separate defamation lawsuits they have filed against the company.

In late April, The Gateway Pundit filed for Chapter 11 bankruptcy protection. In an article to its readers, Gateway Pundit founder Jim Hoft wrote it was filing for bankruptcy “as a result of the progressive liberal lawfare attacks against our media outlet,” and added “Despite the radical left’s efforts to silence The Gateway Pundit through censorship, de-platforming, de-banking, cut-off from advertisers, and other financial strategies, we will not be deterred from our mission of remaining fearless and being one of the most trusted independent media outlets in America today.” At the end of the post, Hoft linked to an online fundraising platform where he is soliciting donations via an organization called “The Justice League” to protect the company from “constant assault by numerous institutions on the left.”

The Gateway Pundit told the court that it is filing for bankruptcy because of “multiple litigations that threaten the Debtor’s continued viability and ability to continue operations.” The Gateway Pundit remains a very influential conservative media outlet; its own stats show that it is getting between 2 million and 3 million pageviews per day. Hoft and The Gateway Pundit’s lawyers did not respond to multiple requests for comment for this story.

Specifically, The Gateway Pundit is being sued for defamation in both Missouri and Colorado by two 2020 Georgia election workers, Ruby Freeman and Shane Moss. Soon after the 2020 election, The Gateway Pundit ran 29 separate articles alleging that Freeman and Moss committed election fraud to help Joe Biden beat Donald Trump. Both Freeman and Moss were cleared by an official Georgia investigation. Neither of the defamation cases have been decided yet, however, and are unlikely to be decided in the near future according to Freeman and Moss’s attorneys. The Gateway Pundit’s legal fees in these cases are currently being paid by a defamation insurance policy.

In a filing last week, Freeman and Moss’s attorneys allege that The Gateway Pundit’s Chapter 11 bankruptcy filing is intended to delay or kill their defamation cases, because the cases were immediately put on hold after The Gateway Pundit filed for bankruptcy: “This chapter 11 filing is just the newest effort—in a long line of failed tactics—to prevent the Freeman Plaintiffs from proving their claims in a court of law.”

When a company or person files for bankruptcy, there is an immediate “stay” of all attempts to collect debts from them, and on all litigation against them. That means the defamation cases against the Gateway Pundit have been frozen indefinitely, and Freeman and Moss are trying to get the court to allow their cases to proceed.

“The Gateway Pundit’s chapter 11 filing has all the hallmarks of a case warranting dismissal. The Debtor is cash-flow positive and easily able to meet its debts in the ordinary course of business. The Debtor has few assets and only one employee,” Freeman and Moss’s filing says. “Outside of the Missouri Litigation and a separate defamation lawsuit pending in Colorado—neither of which is close to trial—there are few creditors, all with de minimis [insubstantial] claims. The bankruptcy filing’s timing seems designed to delay the Hoft brothers’ depositions in the Missouri Litigation (which were to take place at the end of May). Prior to the petition date, the Debtor made highly suspicious loans and other payments to the Hoft brothers. Put simply, the red flags here are large and numerous. This case [the bankruptcy] is a pure litigation tactic.”

The filing claims that this is the latest in what Freeman and Moss’s attorneys argue is “a series of delay tactics.”

Since The Gateway Pundit filed for bankruptcy, I have been reading court documents and financial records filed as part of the proceedings. The documents reveal a handful of interesting things about the operations of one of the most prominent conservative media outlets, which regularly drives and amplifies conservative talking points and narratives. In the bankruptcy filing, The Gateway Pundit lists itself as an “opinion website.”

Three bankruptcy law professors, including a former bankruptcy court judge, reviewed the Gateway Pundit’s court docket, and told me that outside of the pending litigation, they do not see anything that suggests the company is in financial duress, other than the fact that it may, potentially, have to eventually pay damages if it loses the court cases against it.

Every financial document filed by the company shows that it has enough money to pay all of its bills, that its expenses are low, and that it does not owe anyone any substantial sums of money. Monthly bank statements show that it has never come close to overdrafting and that it is running a profitable business.

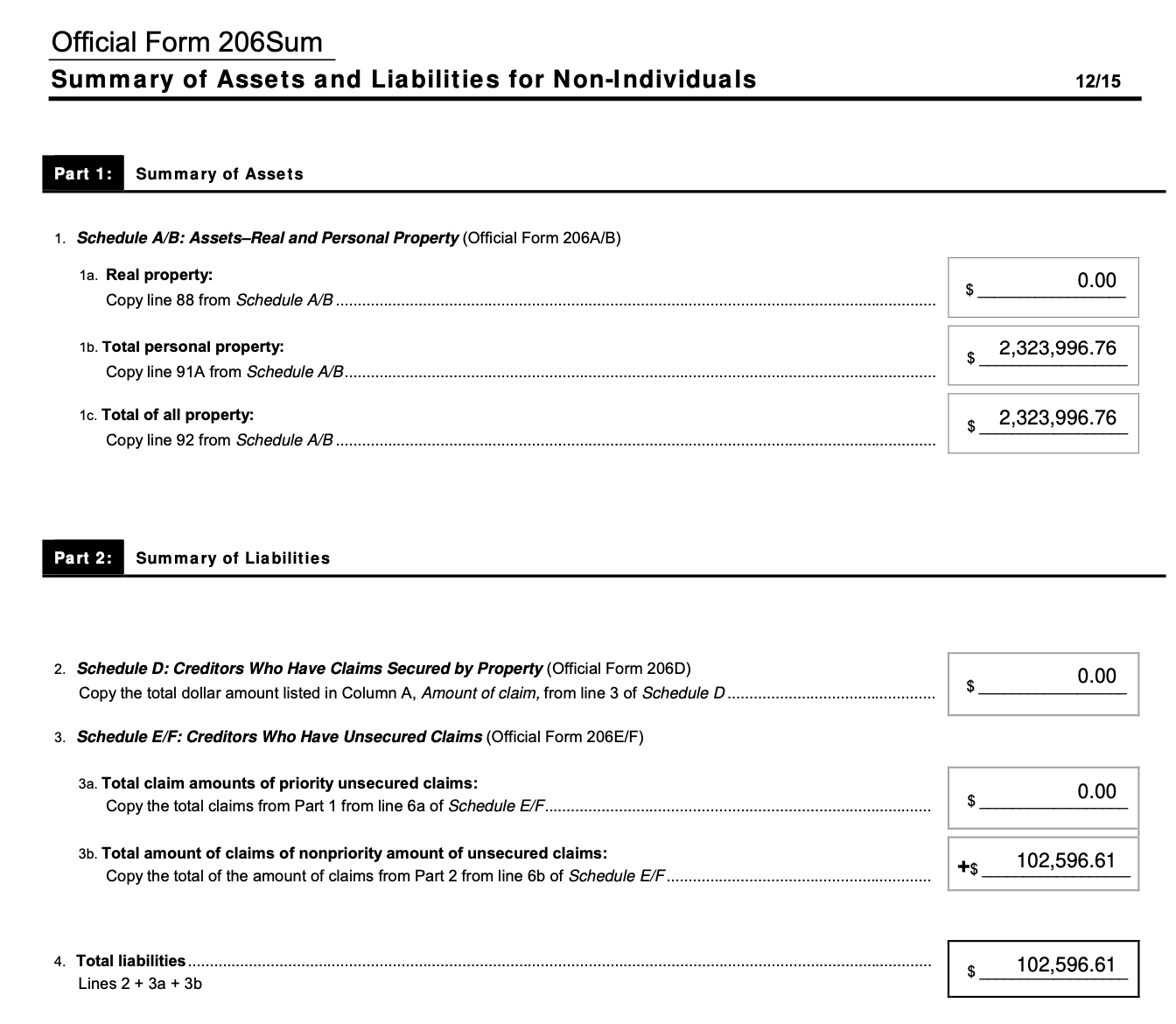

Documents in the bankruptcy filing show that the Gateway Pundit does not have large debts. Its largest listed debt is to an anonymous “Jane Doe” for $16,546. Its second largest debt is $11,062 owed to Jez Morano, who is the husband of Jim Hoft, for “Telephone/Internet Services.” A filing from the end of May shows that the company has $2.32 million in assets against total debts of $102,596. It has $185,757 in cash in its bank accounts, $107,617 in one Charles Schwab investment account, $491,569 in another Charles Schwab investment account, and $497,511 in a 401(k). The company recently loaned Hoft $799,860 in connection with a condominium, and is says it expected to receive $150,000 to “The Justice League,” which is the group it is currently soliciting donations through.

In the three months before filing for bankruptcy, the company made a $17,280 payment to Hoft, a $33,186.17 payment to Hoft’s husband, and a $95,000 payment to The Justice League. The company also lists a 2021 Porsche worth $53,339 among its assets. It also lists among its assets the entirety of The Gateway Pundit’s website, which has published 140,000 articles and lists its value as “unknown.”

The company has just one shareholder and one employee: Jim Hoft. Its own documents show that it is cashflow positive and has been cashflow positive for quite some time. The documents show that Gateway Pundit relies on a network of contractors and freelancers to write and publish content on the website, and some of these contractors are listed as being owed money. But, in total, they are owed just a tiny fraction of what The Gateway Pundit has in the bank.

In recent years there has been a wave of otherwise solvent companies and entities that have preemptively filed for bankruptcy while they have pending litigation against them, which has become a new tactic to delay the litigation. The National Rifle Association, for example, filed for bankruptcy and had the case thrown out because it was not actually insolvent. The law professors I spoke to all pointed out that Johnson & Johnson similarly had its bankruptcy thrown out of court.

“If I was the judge in this case, I would have dismissed this yesterday,” Bruce A. Markell, a professor of bankruptcy law at Northwestern University Pritzker School of Law and former U.S. Bankruptcy Court Judge in Nevada told me. “Outside of the pending cases, it is absolutely not in financial distress.”

“From my perspective, this is a tactic that is being used far too often by people who want to evade accountability and want to run behind a statute that gives them some temporary relief,” Markell added. He then told me this joke, about a man being sentenced to death who is able to delay his sentence by a year by promising to make a horse sing. “That’s kind of the attitude of something like this. You know, ‘Maybe if we can stay this, maybe something happens.’ Time is the friend of the desperate debtor.”

Jay Westbrook, a professor at the University of Texas school of law, told me in an email that “Alex Jones is the classic example, which has not worked, although the rapper 50 Cent is another good one. Both did buy a lot of delay. Most of the action is with corporations like Johnson and Johnson (huge verdicts on asbestos in talcum powder) but the most famous is Purdue, about to be decided any day by the US Supreme Court. For the most part, the idea is to use the bankruptcy stay of litigation as a device to force a cheaper settlement. Success is uneven.”

There are several other notable things that have come out in the Gateway Pundit’s Chapter 11 filings. The company has sought to keep the names of some of its writers private. It told the judge that it wants to do this because “given the conservative nature of the Debtor’s publications and opinions, many of the Contract Writers are subject to extreme criticisms from other less conservative groups. Further, in the past, several of the Contract Writers have received threats of bodily harm from groups and individuals.” In Freeman and Moss’s filing, the former election workers allege that The Gateway Pundit’s articles led directly to death threats against them and their families, examples of which are included in their filings.

An attorney representing the United States rejected this premise and argued that bankruptcy proceedings are intended to give great transparency into business operations: “Disclosure is a basic premise of bankruptcy law,” they argued in a filing with the court. “Here, with nothing more than vague statements supporting the request, the Debtor seeks extremely broad authority to redact all information relating to the Contract Writers … In addition to creating unfavorable precedent in this and other media industry chapter 11 cases, allowing the Debtor to file incomplete creditor lists and schedules and statements is a slippery slope. Does the Debtor intend to conduct its claim objections under seal? Will certain creditors’ treatment in a plan be redacted? Will objections to the disclosure statement and confirmation also be sealed? Will the hearings before the Court in this case have to be repeatedly closed? It is well settled that, as a matter of promoting the integrity of the judicial system, bankruptcy proceedings must be open and transparent.”

The filings also give some insight into how The Gateway Pundit makes its money, and how much it is making. The company brought in nearly $3.1 million in revenue in 2023, and made $725,128 through the end of April this year. It has $10,000 in a Coinbase cryptocurrency account, and $25,000 in a Robinhood investment account. In the first quarter of 2024, it made $3,640 from Twitter and $83,363 from the conservative social media platform Rumble. It also lists $342,304.70 in income from an entity called “Economic Advisors,” $146,667.47 in income from someone named Christopher D Do, and $96,224.26 in income from a company called Leven Labs Inc. It has made $12,787 in income from Zelenko Labs, which advertises supplements that are supposed to treat COVID-19 using “zinc ionophores” on the website. In the first quarter of 2024, the Gateway Pundit claims to have made a $248,037 profit.